How financial services companies mitigate risk

You need the right tools to stay on top of the growing list of risks and regulations that are impacting your bottom line. Our intelligent technology and experience can help.

Manage and protect budgets with connected, intelligent technology

Manage and protect budgets with connected, intelligent technology

Reclaiming VAT on travel and expense costs is a great way to put some money back into your budget. But you also need to keep up with continually changing regulations. Download our IDC report to learn about intelligent processes that can help you:

- Enforce spending limits to reduce non-compliance

- Get greater visibility into travel expense costs

- Increase the productivity of your employees

The risk of regulatory non-compliance

The risk of regulatory non-compliance

Last year, the largest penalty for violating the Foreign Corrupt Practices Act was $956 million.* Download our infographic to identify your weak spots. Get analysts’ recommendations on how financial services leaders should manage risk and compliance.

*The FCPA blog

Manage and protect budgets without compromising on compliance

Manage and protect budgets without compromising on compliance

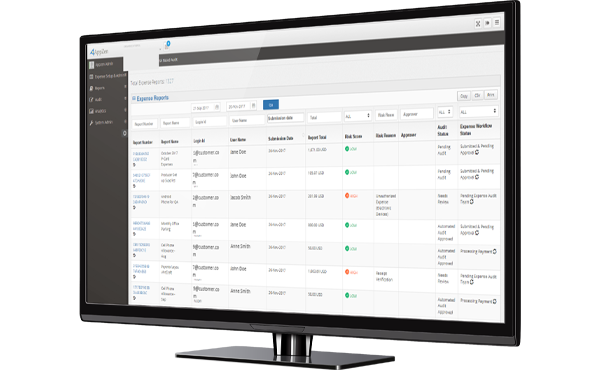

With complex rules and regulations around business conduct and data security, global compliance is essential. You need a sophisticated travel and expense solution, supported by an auditing team, to protect your business from duplication, errors and fraud. Take our assessment to see how mature your travel expense solution is.

For financial services, expense fraud is the most common risk and can be the most costly

For financial services, expense fraud is the most common risk and can be the most costly

50% of fraud is caused by poor internal control, leading to loss of cash flow visibility.* Improving policies and audit processes can drive compliance, control costs, and identify bad behaviours.

2018 ACFE report*

What you need to improve travel and expense policy for better performance

What you need to improve travel and expense policy for better performance

When you have a documented submission process, spend visibility, and compliance monitoring, the results are impressive, according to Aberdeen.

- 84% spend management improvement*

- 71% increase in employee adoption*

- 84% compliance*

*The Aberdeen report

Achieve better business outcomes with SAP Concur

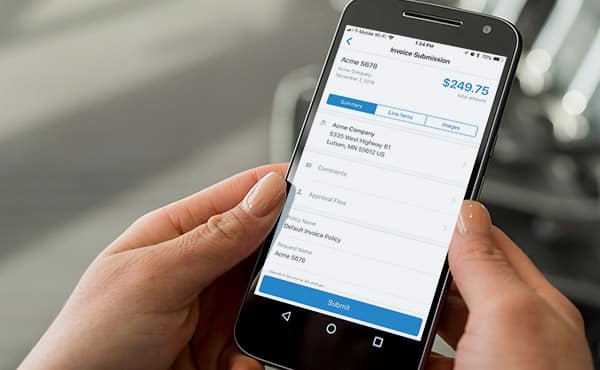

Increased efficiencies. Global visibility. Increased cost savings. See how SAP Concur provided better business outcomes for two major financial services organisations.

Gaining spend visibility across countries, simplifying expense types, and consolidating global travel & expense policy

See how Barclays has gained access to integrated Travel & Expense data with SAP Concur solutions

Streamlining expense management to save time and money

With SAP Concur, expense claims are quickly processed and paid, limiting the administrative workload so employees can focus on the more challenging aspects of their work.

Contact us to see a better way to manage spend.

Contact us to learn more about SAP Concur solutions.

Thank you for contacting us about a better way to manage travel, expenses or invoices.

We have received your request for information, and we will be in touch with you soon.